All Categories

Featured

Table of Contents

We use data-driven techniques to review economic products and services - our reviews and rankings are not influenced by marketers. Limitless financial has caught the rate of interest of several in the individual financing world, assuring a path to economic liberty and control.

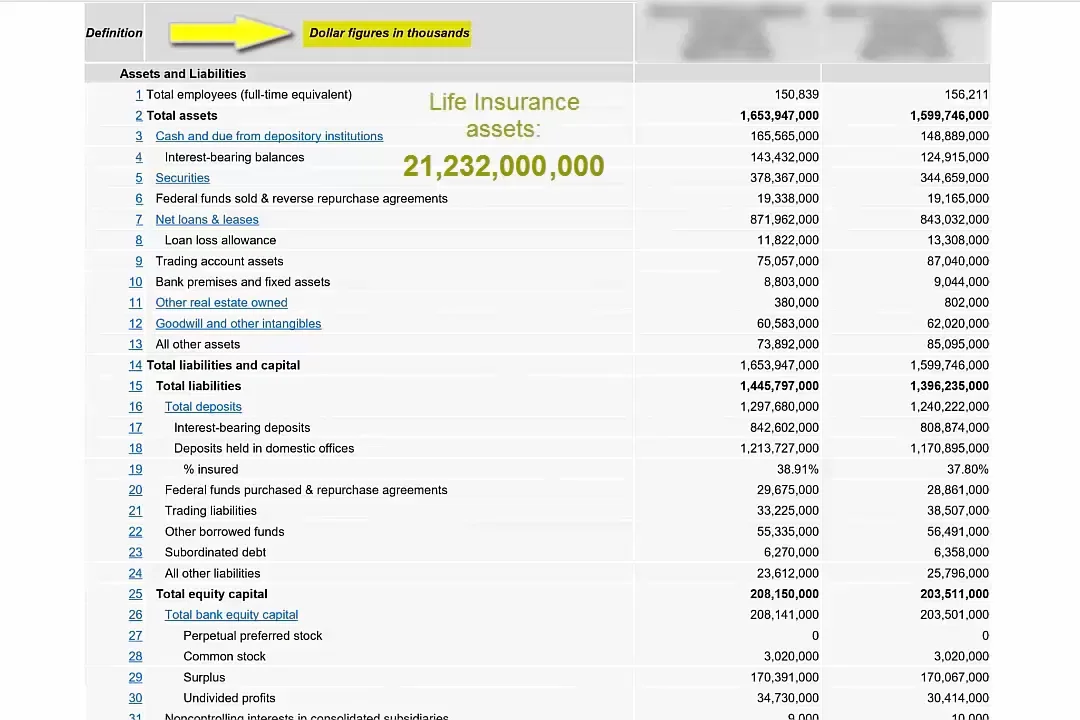

Limitless banking refers to a monetary approach where an individual becomes their very own lender. This idea focuses on the use of whole life insurance policy policies that build up cash money worth in time. The insurance holder can borrow against this cash money value for numerous economic needs, efficiently lending cash to themselves and paying off the policy by themselves terms.

This overfunding speeds up the growth of the policy's cash worth. Unlimited financial supplies many advantages.

What are the benefits of using Infinite Banking Vs Traditional Banking for personal financing?

It involves making use of an entire life insurance coverage plan to produce a personal financing system. Its efficiency depends on various factors, including the policy's structure, the insurance business's performance and exactly how well the technique is handled.

It can take numerous years, commonly 5-10 years or more, for the money worth of the plan to grow completely to begin borrowing versus it effectively. This timeline can differ depending on the plan's terms, the costs paid and the insurance company's performance.

Whole Life For Infinite Banking

So long as costs are existing, the policyholder just calls the insurance business and requests a loan versus their equity. The insurer on the phone won't ask what the lending will be utilized for, what the revenue of the debtor (i.e. insurance policy holder) is, what other possessions the person might have to work as security, or in what timeframe the person plans to pay back the finance.

In comparison to describe life insurance policy items, which cover just the recipients of the insurance policy holder in the event of their death, whole life insurance coverage covers an individual's entire life. When structured correctly, whole life plans produce an one-of-a-kind revenue stream that enhances the equity in the plan over time. For more analysis on how this works (and on the pros and cons of entire life vs.

In today's world, globe driven by convenience of consumption, usage many also lots of granted our approved's country founding principlesStarting concepts and flexibility.

What is the long-term impact of Infinite Banking Vs Traditional Banking on my financial plan?

It is an idea that permits the insurance policy holder to take lendings on the entire life insurance coverage policy. It must be readily available when there is a minute monetary problem on the person, wherein such lendings might help them cover the financial load.

Such abandonment value acts as money collateral for a lending. The insurance holder requires to link with the insurance provider to ask for a financing on the plan. A Whole Life insurance policy policy can be called the insurance policy item that offers security or covers the individual's life. In the event of the feasible fatality of the person, it provides financial safety and security to their relative.

The policy may call for monthly, quarterly, or yearly payments. It starts when a private occupies a Whole Life insurance policy plan. Such plans may spend in business bonds and federal government safeties. Such plans keep their worths because of their conservative method, and such plans never ever spend in market tools. Limitless banking is a principle that enables the insurance policy holder to take up car loans on the whole life insurance coverage plan.

How does Bank On Yourself compare to traditional investment strategies?

The cash money or the surrender value of the entire life insurance policy acts as security whenever taken fundings. Expect a private enrolls for a Whole Life insurance policy policy with a premium-paying term of 7 years and a plan period of twenty years. The individual took the policy when he was 34 years old.

The security derives from the wholesale insurance coverage policy's cash money or surrender worth. These elements on either extreme of the range of realities are gone over below: Boundless financial as a monetary advancement improves money flow or the liquidity profile of the insurance holder.

What is the best way to integrate Self-financing With Life Insurance into my retirement strategy?

The insurance plan finance can likewise be available when the individual is jobless or dealing with wellness problems. The Whole Life insurance coverage policy preserves its total worth, and its performance does not link with market performance.

Usually, acts well if one entirely depends on banks themselves. These principles benefit those who have solid financial capital. Additionally, one must take only such policies when one is financially well off and can manage the policies premiums. Limitless banking is not a fraud, however it is the most effective point many individuals can go with to improve their financial lives.

How do I leverage Infinite Banking Account Setup to grow my wealth?

When people have limitless financial described to them for the very first time it appears like a wonderful and risk-free way to expand wide range - Infinite Banking cash flow. The concept of replacing the despised financial institution with borrowing from on your own makes a lot even more feeling. But it does call for replacing the "disliked" financial institution for the "hated" insurance policy business.

Of program insurance policy companies and their agents enjoy the principle. They designed the sales pitch to market more entire life insurance.

There are 2 major economic calamities constructed right into the infinite financial principle. I will expose these imperfections as we function via the mathematics of exactly how boundless financial truly functions and just how you can do much far better.

Table of Contents

Latest Posts

Can anyone benefit from Policy Loans?

How do I optimize my cash flow with Tax-free Income With Infinite Banking?

Who can help me set up Financial Leverage With Infinite Banking?

More

Latest Posts

Can anyone benefit from Policy Loans?

How do I optimize my cash flow with Tax-free Income With Infinite Banking?

Who can help me set up Financial Leverage With Infinite Banking?